most complete pet insurance: field-tested breakdown

I review claims right after treatment plans hit the counter. Marketing copy says "complete." Charts tell me whether that holds up. Here's how the promise survives contact with real invoices.

What "complete" actually covers in practice

In clinics, a complete policy consistently clears these hurdles without nickel-and-diming the client at every step.

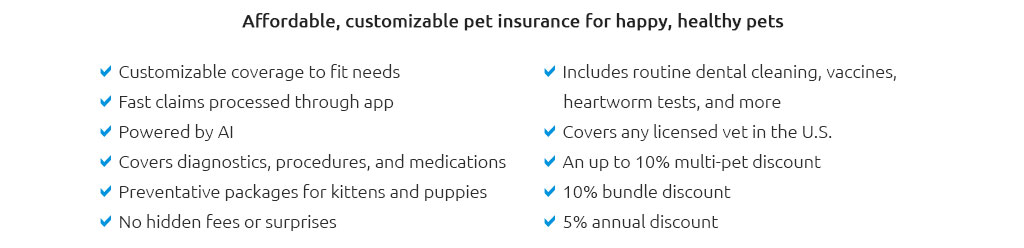

- Accident + illness as the base, including hereditary and congenital conditions.

- Chronic conditions covered every year, no hidden per-condition lifetime caps.

- Exam fees and recheck visits paid, not just the procedure that follows.

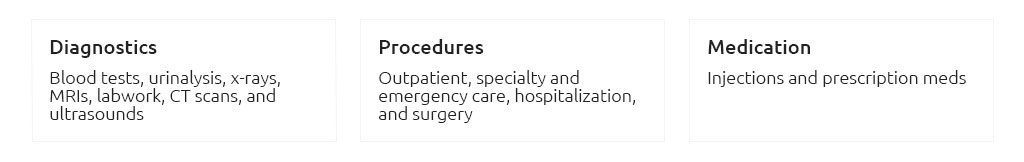

- Diagnostics: in-house labs, send-out panels, X-ray, ultrasound, CT/MRI when medically necessary.

- Medications: acute and long-term maintenance, with sensible formularies.

- Dental illness coverage beyond trauma, including extractions and periodontal disease when vet-documented.

- Rehab and alternative therapies (PT, acupuncture, hydro) when prescribed.

- Specialist and ER facility fees, overnight hospitalization, and monitoring surcharges.

- Behavioral therapy when diagnosed and treated by a veterinarian.

- End-of-life care: euthanasia fees and cremation or burial allowance.

- Tele-vet consults reimbursable, not just "advice lines."

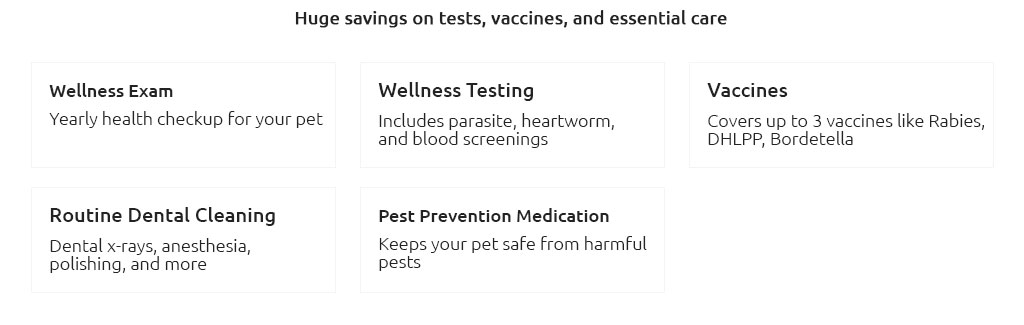

- Optional wellness add-on with realistic caps, not token coupons.

Where policies diverge even when they say "complete"

The fine print controls how much you actually recover. The math matters as much as the list of covered events.

- Deductible design: annual vs per-condition; higher deductibles often reduce premiums but can punish multi-issue years.

- Reimbursement method: percentage of actual vet bill vs internal schedule; the latter looks neat and pays less.

- Caps: annual vs lifetime vs per-incident; sub-limits for dental, rehab, imaging can undercut "complete."

- Waiting periods and bilateral clauses (knees, elbows) that treat the second side as pre-existing.

- Exam fee inclusion: easy to miss, expensive to lack, especially in ER settings.

- Prescription diets and supplements: rare but valuable for GI and derm cases.

- Direct pay to the clinic vs reimburse-the-owner; a convenience difference that feels huge on ER nights.

- Pre-authorization options for big-ticket procedures; reduces claim friction.

- Age and enrollment rules: upper-age cutoffs, recent exam requirements, hip-specific waits.

Comparison notes from the treatment side

These patterns repeatedly shifted outcomes in my case files.

- Exam fee coverage shaved meaningful out-of-pocket on every recheck, not just emergencies.

- No sub-limits on imaging stopped nasty surprises during pancreatitis and oncology workups.

- Annual deductible worked best for pets needing care more than once per year; per-condition deductibles piled up fast.

- Dental illness inclusion prevented the "trauma only" dead-end that leaves periodontal disease owners stranded.

- Behavioral coverage mattered for separation anxiety and reactivity cases that now use structured treatment plans.

Pricing patterns and value reality

I can't guarantee your premiums will pencil out every single year. Over a 5 - 8 year horizon with even one major event, the most complete designs reduced total spend more often than not, and - just as important - kept decisions clinical rather than financial.

Claims and admin speed

Coverage is only half the story; payout velocity keeps owners on plan.

- Clear medical records and invoices lead to faster decisions. Vague notes slow everything.

- App-based claim uploads with itemized receipts cut days off processing.

- Pre-approval for surgeries turns "maybe" into "go" before anesthesia.

Exclusions that quietly matter

- Pre-existing conditions, including symptoms noted before enrollment.

- Elective and cosmetic procedures (declaws, tail docking) unless medically required.

- Breeding-related costs and routine pregnancy care.

- Experimental or non-evidence-based therapies beyond stated lists.

- Administrative fees not tied to medical necessity.

A quiet real-world moment

Saturday, 10:40 p.m., suspected foreign body. The plan on file included exam fees, ER surcharges, imaging, and hospitalization. Surgery cleared through pre-authorization while we placed an IV. Owner covered the deductible and co-pay; everything else paid per policy. They went home to sleep, not to scramble for a credit card. That's what "complete" feels like at the desk.

Red flags dressed as "complete"

- "Comprehensive" - but dental illness excluded; accidents only.

- Generous annual cap paired with tiny sub-limits for imaging or rehab.

- Fee schedules that reimburse far below regional costs.

- Wellness bundle that subtracts from illness payout or inflates premium disproportionately.

- Bilateral clause that voids the second knee or elbow after the first is diagnosed.

Quick evaluation checklist

- Confirm accident + illness with hereditary/congenital included; verify no per-condition lifetime cap.

- Require exam fee coverage and no sub-limits on diagnostics or dental illness.

- Pick an annual deductible and 80 - 90% reimbursement on the actual vet bill.

- Check waiting periods, bilateral wording, and age rules against your pet's history.

- Test the claims app once; speed matters when it's midnight and noisy.

Who benefits most

- Young pets (clean slates) locking terms before issues appear.

- Breeds with orthopedic, cardiac, or derm predispositions.

- Owners far from referral centers who rely on ER and tele-vet to triage.

- Households that prefer predictable budgets over shock outlays.

Where "complete" stops

No policy erases pre-existing conditions or covers everything your vet can imagine. The goal is simple: minimize exclusions that matter, and make the reimbursement math fair.

Bottom line

The most complete pet insurance reads clean, pays on what you actually get billed, and avoids sub-limits that hollow out claims. If two options look similar, pick the one with exam fee coverage, annual deductible, plain-language dental illness terms, and documented fast claims. Compare calmly; you'll see the gaps once you read the definitions line by line.