|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

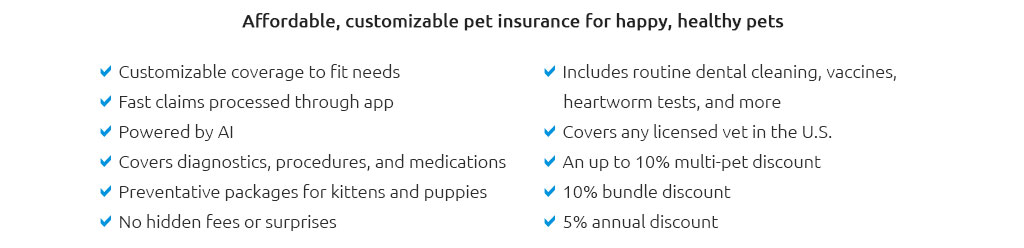

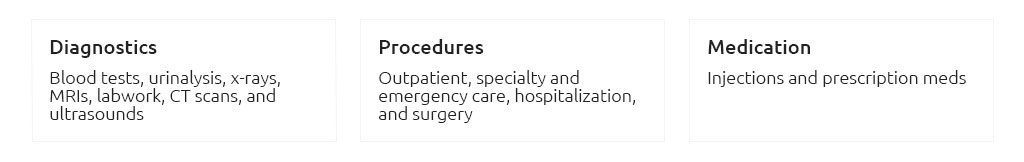

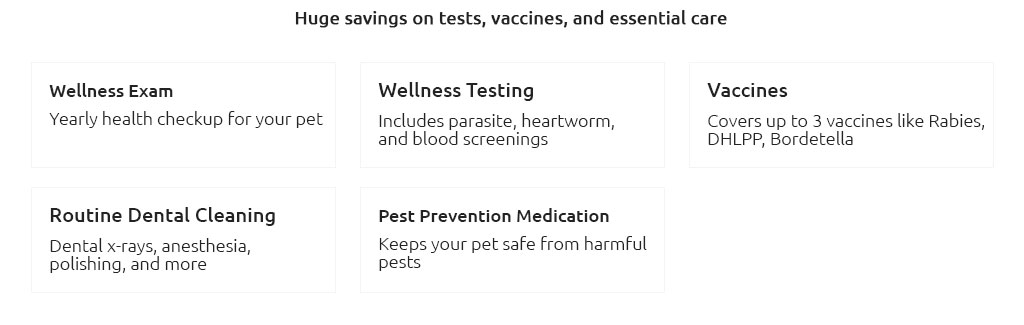

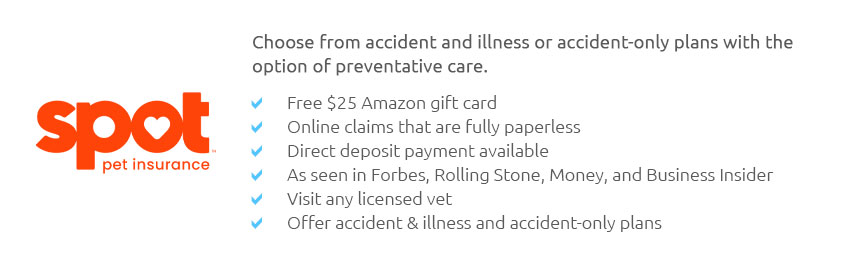

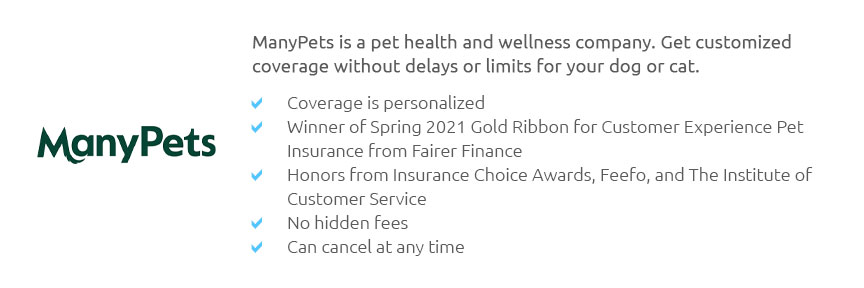

Understanding the Most Complete Pet Insurance: Common Mistakes to AvoidIn the vast world of pet ownership, ensuring the health and well-being of our furry companions is paramount, which brings us to the often-overlooked yet essential topic of pet insurance. But with an overwhelming array of options, how does one navigate the labyrinth to find the most complete pet insurance? It begins with understanding not only what coverage suits your needs but also recognizing the common pitfalls that many pet owners encounter. First and foremost, the term 'most complete' is subjective, often shaped by the specific needs of the pet and its owner. However, several key elements universally define comprehensive pet insurance. At its core, a robust policy should encompass accident and illness coverage, wellness care, and optional add-ons for hereditary conditions. Yet, it’s crucial to delve beyond the surface. One major mistake is underestimating the importance of accident and illness coverage. While wellness care, which includes routine check-ups and vaccinations, is essential, unexpected accidents or illnesses can result in exorbitant veterinary bills. Therefore, a thorough policy should prioritize these aspects. Additionally, hereditary and congenital conditions often lurk beneath the radar, leading to financial strain if not covered. Hence, assessing the breed-specific predispositions is vital. Another frequent oversight is not reading the fine print. Exclusions and waiting periods can significantly impact the effectiveness of a policy. Owners often realize too late that certain conditions or treatments are not covered. Therefore, scrutinizing the details cannot be overstated. Furthermore, the tendency to delay purchasing insurance until the pet is older can be costly, as premiums typically rise with age, and pre-existing conditions become a limiting factor. Moreover, balancing deductibles, premiums, and reimbursement levels requires careful consideration. While a lower premium might seem appealing, it often comes with higher deductibles or lower reimbursement rates, which may not be economical in the long run. Evaluating these factors in light of your financial situation and the pet’s health history is crucial. Lastly, overlooking the significance of customer service and claim handling can lead to dissatisfaction. A policy might appear comprehensive on paper, but the true test lies in the efficiency and empathy with which claims are processed. Researching reviews and ratings can provide insight into a company's reputation in this regard. In conclusion, finding the most complete pet insurance involves a delicate balance of coverage, cost, and clarity. By avoiding these common mistakes, pet owners can secure a policy that not only protects their beloved companions but also offers peace of mind. After all, our pets are family, and they deserve nothing less than the best. Frequently Asked QuestionsWhat should I look for in a pet insurance policy? Look for coverage that includes accidents, illnesses, wellness care, and hereditary conditions. It's also important to understand the policy's exclusions and waiting periods. Are hereditary conditions important to cover? Yes, hereditary conditions can lead to significant costs, especially if your pet's breed is predisposed to certain health issues. Coverage for these conditions is crucial for comprehensive protection. How do I balance premiums, deductibles, and reimbursement levels? Consider your financial situation and your pet's health history. Lower premiums often mean higher deductibles or lower reimbursements, so find a balance that works for your budget and potential veterinary needs. Why is customer service important in pet insurance? Efficient and empathetic customer service ensures smooth claims processing and helps resolve issues quickly, providing peace of mind when you need it most. https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ... https://www.progressive.com/pet-insurance/

These comprehensive plans cover emergency care, diagnostic testing, specialist visits, and more. You can also customize your deductible, reimbursement ...

|